Invest in Women!

Let’s be honest. Even if some of us feel uncomfortable accepting it, Money IS power.

Power to do what you want. Power to implement your own projects and see them grow. Power to be free and independent.

And yet, the investment arena is still an extremely male-dominated world.

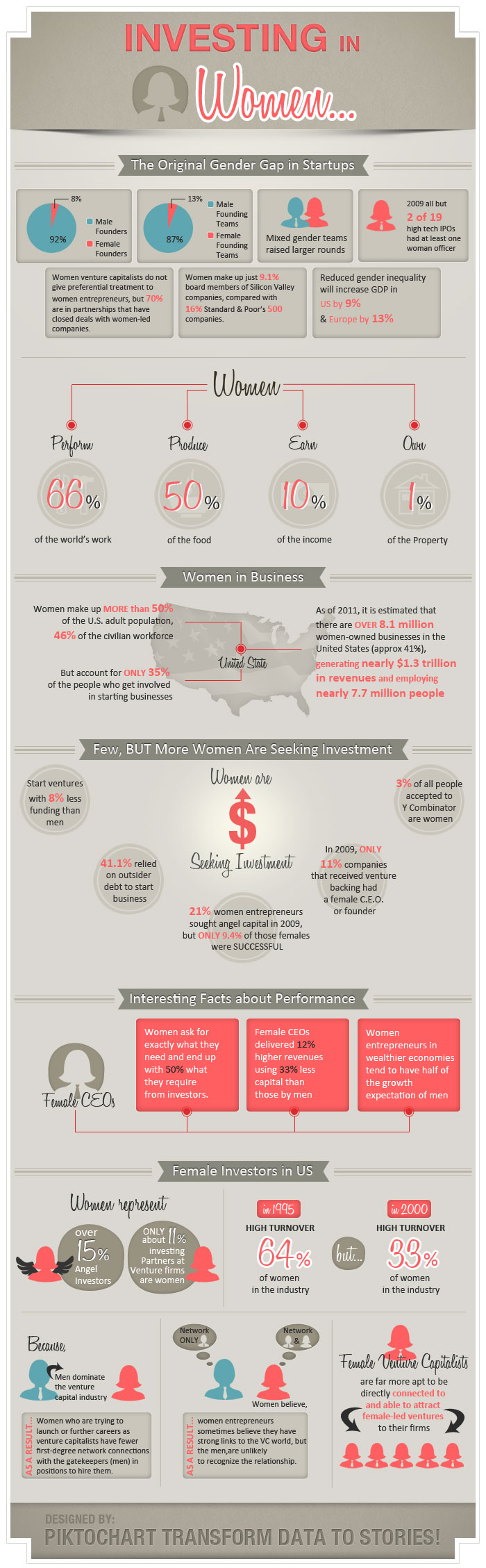

In the United States only, women represent 15% of angel investors and 11% of investing partners at VC firms according to this infographic. Although women are highly active in the philanthropic world, giving millions of dollars each year, they account for only a small percentage of the world’s investors.

This undeniable fact has massive consequences:

- On the local and national level, there is a lack of support networks to encourage women to develop growth-oriented ventures. Access to capital is among the leading challenges confronting women entrepreneurs: women-led companies actually receive less than 12% of venture capital invested, and substantially less angel capital as well.

- At a global level, the lack of diversity in the investment and leadership world leads to an economic system shaped on a unique set of values, as underlines Halla Tomasdottir, the founder of Audur Capital in her TED talk. And this vision mostly focused on economic return above all actually led us to a massive economic crisis.

Fine. But why shall we invest in women then?

Because venture-backed companies led by a woman actually produce 12% higher revenues and launch on a third less capital than their male counterparts, as show studies by the Kauffman Foundation and leading universities. They have a record of greater capital efficiency and a lower failure rate than companies only run by men.

According to DELL study, companies with more women board directors outperform those with the least by 66% ROI capital, 53% return on equity and 42% return on sales.

Venture capital firms that invest in women-led companies outperform those that don’t, according to research from the Small Business Administration’s Office of Advocacy.

And venture-backed companies that include more women on their executive management teams are more likely to succeed than companies with men-only executive suites, according to Women at the Wheel: Do Female Executives Drive Start-up Success, research conducted by Dow Jones.

But women are not only wise entrepreneurs and managers.

They are also drivers of economic growth.

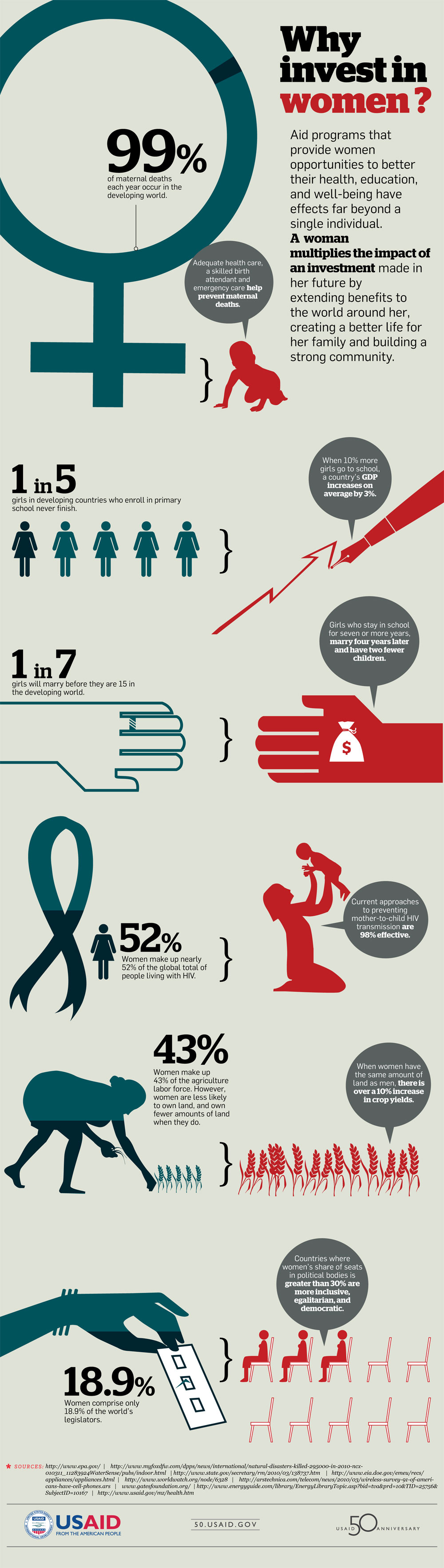

A woman multiplies the impact of an investment by extending benefits to the world around her, creating a better life for her family and building a strong community. Just as an example:

- When 10% more girls go to school, a country’s GDP increases on average by 3%.

- When women possess the same amount of lands as men, the crop yields increase by minimum 10%.

- In Europe, reducing gender inequality would increase GDP by 13%.

Enabling women, particularly as entrepreneurs, benefits future generations because women tend to spend more on their children’s education and health, which should boost productivity as well.

When women are economic agents, social change accelerates and returns multiply.

As Hillary Clinton underlined it, “Investing in women is not only the right thing to do, but also the smart thing to do.”

As entrepreneurs. But also as consumers.

85% of consumer purchases are actually made by women. They control $12 trillion of the overall $18.4 trillion in global consumer spending and in the next 3 years, the World Bank predicts that the global income of women will grow by more than $5 trillion.

Women are the next global emerging market. Their economic power is truly revolutionary, representing the largest market opportunity in the world. And who talks better to a woman consumer than a woman entrepreneur or creative director?

Investing in women would finally allow a greater diversity and foster the incorporation of different values in our economic model.

Women entrepreneurs see the world through a different lens and, in turn, do things differently. They tend to take a holistic approach, looking for both economic and emotional capital, uniting financial and social return. Aiming at profit with principles. And economic returns ARE still better.

To sum up, there is a need for a durable and systemic change for women worldwide – both as investors and beneficiaries of invested capital.

Different initiatives exist to act at different stages of the process:

- Women Effect Investments is building the field of Gender Lens Investing – which means considering gender when making investment decisions and oftentimes directly benefiting the lives of women and girls.

- The JumpFund’s invests women’s capital in female-led companies with growth potential.

- Astia Angels is a global network of female and male angel investors that invests in women-led, high-growth ventures.

- Organizations such as Springboard Enterprises have helped women entrepreneurs become more scalable and attract investment.

- The Pipeline Fellowship, an angel investing bootcamp, is educating women on how to be angel investors

- Advertising companies like 85% tend to advise brands on how to communicate to the 85% of the people who are actually making purchasing decisions.